san francisco gross receipts tax apportionment

Web The voters of San Francisco the City recently approved Proposition E a gross receipts tax that will be phased in over five years beginning in 2014. Web Thats because San Francisco asks businesses to calculate their gross receipts tax burden in part on the portion of their overall payroll thats earned in the city.

Uc Davis Summer Tax Institute Advanced Income Tax Track Ppt Download

Businesses operating in San Francisco pay business taxes primarily based on gross receipts.

. 1 This gross receipts tax will. Web In an effort to eliminate this perceived tax disincentive in November 2012 San Francisco voters passed Proposition E Prop E enacting the Gross Receipts Tax. Trust And Estate Administration.

While San Franciscos gross receipts tax went into effect beginning January 1 2014. Web John Clausen Managing Director State Local Tax Services. Therefore when you register for a San Francisco.

The City began making the transition to. Web San francisco gross receipts tax instructions 2020 Tuesday February 22 2022 Edit. Web You must pay the 2021-2022 business registration fee by November 1 2021 and our office is missing critical information about your 2020 gross receipts to create your bill.

Web san francisco gross receipts tax apportionment In an effort to eliminate this perceived tax disincentive in November 2012 San Francisco voters passed Proposition E. 3 For the business activities of financial services and professional scientific and technical. Lean more on how to submit these installments.

And Arts Entertainment and Recreation. Web Gross receipts and payroll taxes. Web 0868 eg 868 per 1000 for taxable gross receipts over 25000000.

Web Gross Receipts Tax Applicable to Accommodations. Gross Receipts Tax Applicable to Private Education and Health. Web 8 rows Apportionment for this Section is 50 Real Personal Tangible and Intangible Property and 50.

Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments. Web Gross Receipts Tax and Payroll Expense Tax.

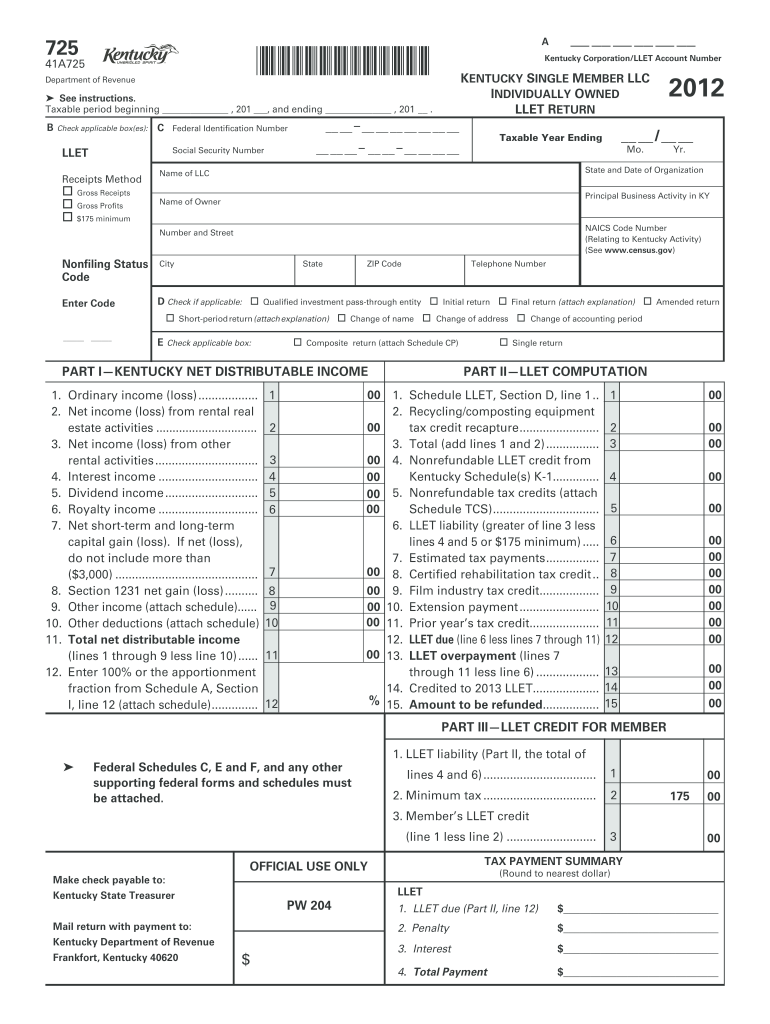

1600010256 Kentucky Department Of Revenue Fill Out Sign Online Dochub

Annual Business Tax Return Instructions 2018 Treasurer Tax Collector

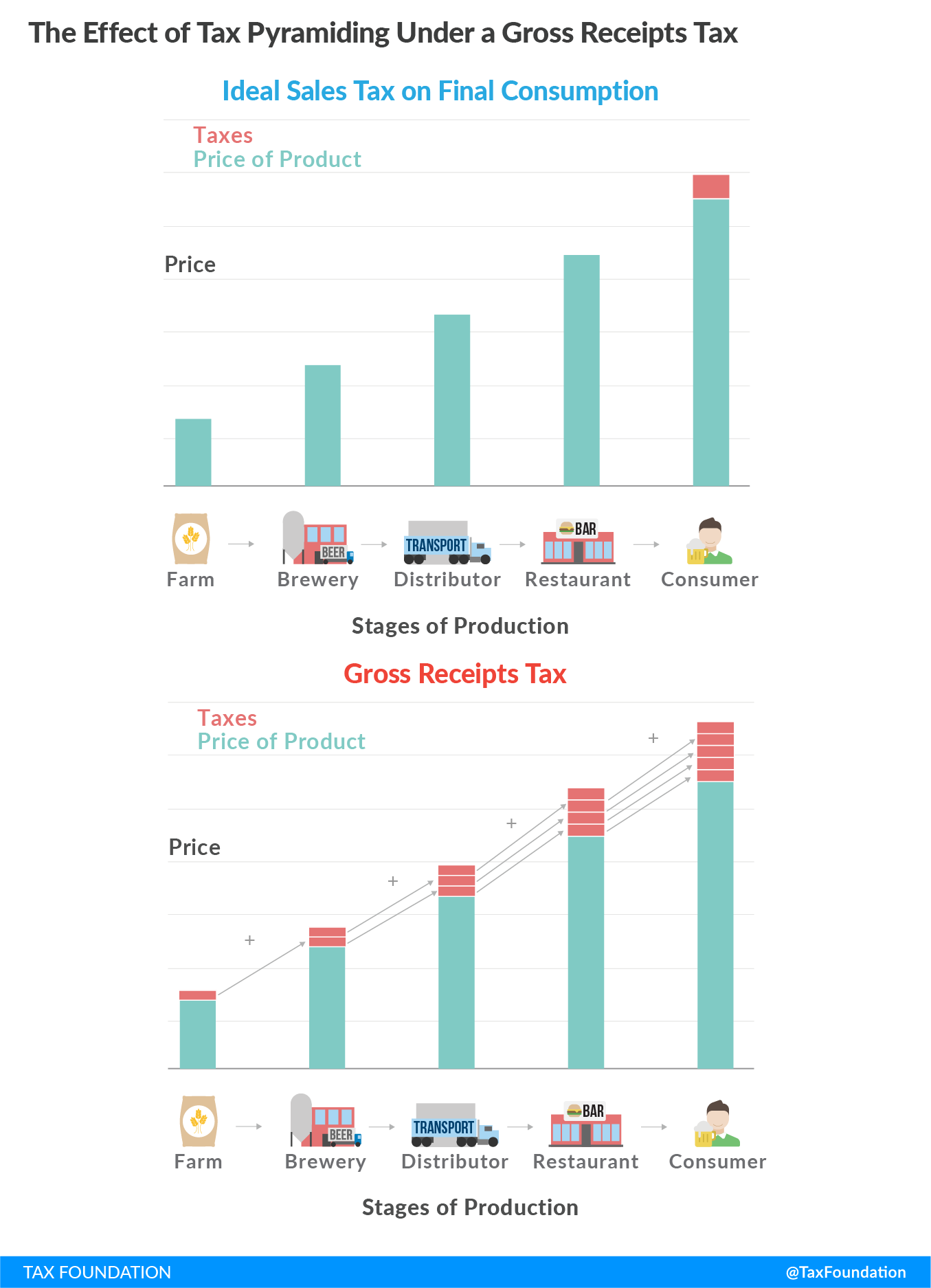

Gross Receipts Taxes Are Making A Dangerous Comeback Tax Foundation

San Francisco Begins Transition To Gross Receipts Tax The Bar Association Of San Francisco

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

State By State Guide Which States Have Gross Receipts Tax Taxvalet Sales Tax Done For You

Pdf Evaluation Of Alternatives To The City S Gross Receipts Business Tax Robert Wassmer Academia Edu

San Francisco S Biggest Companies Now Forced To Pay A Homeless Tax

Texas Comptroller Revisions Dallas Business Income Tax Services

Wait How Would Louisiana S Gross Receipts Tax Work Tax Foundation

State By State Guide Which States Have Gross Receipts Tax Taxvalet Sales Tax Done For You

State Tax Update The Shift From Cost Of Performance To Market Based Sourcing Marcum Llp Accountants And Advisors

San Francisco Passes Proposition C To Increase Gross Receipts Tax On Commercial Landlords Coblentz Law

I Virginia Retail Sales And Use Tax Or Federal And State Excise Tax On Motor Vehicle Fuel Account Number Assigned By State Pdf Free Download

Gross Receipts Taxes An Assessment Of Their Costs And Consequences

Annual Business Tax Returns 2020 Treasurer Tax Collector

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

Got Losses Why Pre Revenue Start Ups And Companies With No Gross Receipts Should Seek Relief From California S Standard Apportionment Formula Andersen

The Nuances Of Market Based Sourcing Of Service Revenue Not All Markets Look The Same Pdf Free Download